2022 Canadian Pension Climate Report Card

Shift’s inaugural Canadian Pension Climate Report Card, released January 18, 2023, analyses the climate policies and strategies of Canadian pension funds based on public information disclosed to December 31, 2022.

Watch a recorded webinar about the report card findings here.

Shift’s inaugural Canadian Pension Climate Report Card reveals that Canada’s major pension funds are not on track to protect pensions from the worsening climate crisis or to align their portfolios with a safe climate future.

The report finds a high level of inconsistency, with the degree of urgency, detail, transparency, and ambition of pension fund approaches varying widely for managing climate-related risks and opportunities across the sector. Far more work is needed to ensure pension managers are fulfilling their fiduciary duty to invest in plan members’ best long-term interests and protect their retirement security in a world that limits global heating to 1.5°C.

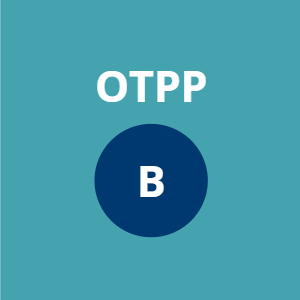

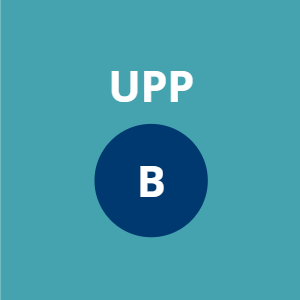

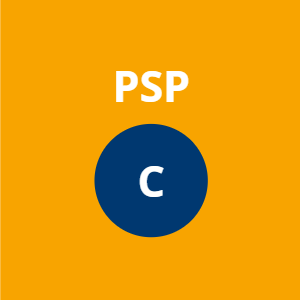

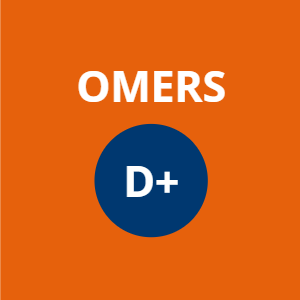

The report offers an independent benchmark for evaluating the quality, depth and credibility of eleven (including the so-called ‘Maple 8’) Canadian pension managers’ climate policies based on the latest science and international best practice. It also includes examples of four international pensions for comparative purposes.

For interview requests, questions or comments, please contact info@shiftaction.ca.

Read the Report

Click to read the media release, executive summary, or to download the report and appendices.

Dive into Each Pension Manager’s Climate Scores

Click on your pension fund for a detailed analysis of its climate scores.

Find Out Why Three Funds Earned Greenwashing Awards

Shift awarded gold, silver and bronze greenwashing awards to three Canadian pension funds for making investment activities appear to be more environmentally friendly or less environmentally damaging than they really are.

Canadian Pension Funds and Indigenous Rights Policies

Four pension managers examined in the report have publicly available information on consideration of Indigenous rights.

Pension Beneficiaries Can Take Action Now

Far more work is needed to ensure pension managers are fulfilling their fiduciary duty to invest in plan members’ best long-term interests and protect their retirement security in a world that limits global heating to 1.5°C. Write to your pension manager now to share your concerns.

French Materials

Download the report’s executive summary and detailed analysis of the CDPQ in French.