Methodology and Scoring

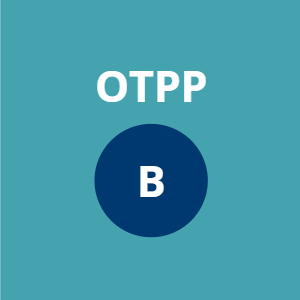

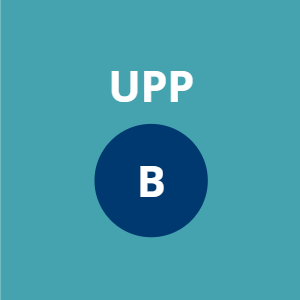

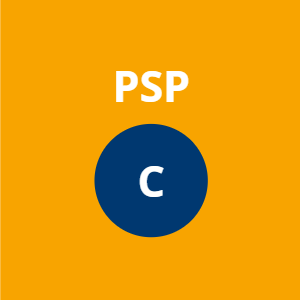

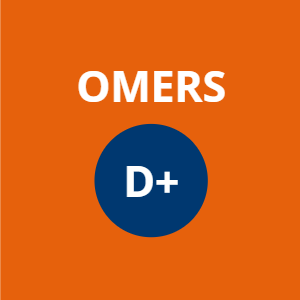

The pension fund assessments in the 2022 Canadian Pension Climate Report Card are based on publicly available information collected over the course of 2022 from the public websites, annual reports, ESG/sustainable/responsible investing reports, climate plans and strategies, regulatory filings, press releases and other publications of pension funds, as well as news articles, briefing notes and reports from academics and civil society organizations. Information is current to December 31, 2022, except where otherwise noted.

The report assessed pension managers and assigned letter grades based on the following qualitative indicators. You can download the complete scoring rubric and references here.

Paris-Aligned Target

Whether or not the pension manager has a clearly-defined portfolio-level target to align its portfolio with the goal of limiting global temperature increase to 1.5°C by mid-century, as outlined in the Paris Agreement. This entails the extent to which the pension manager is committed to reducing the absolute emissions of its portfolio to net-zero by 2050 or sooner, while accounting for scope 3 emissions, the role of offsets, and reducing real-world emissions, as well as membership in a credible and accountable international body defining Paris-aligned pathways for institutional investors, such as the Net-Zero Asset Owner Alliance (NZAOA) or the Paris Aligned Investment Initiative (PAII).

Interim Climate Targets

Whether or not the pension manager has short- and medium-term targets for achieving net-zero emissions, as well as the stringency of these interim targets, including percentage of portfolio covered, inclusion of scope 1, 2 and 3 emissions, and absolute vs. intensity-based targets. Other relevant climate-related interim targets were also considered, for example for increased investments in climate solutions and percent of portfolios intended to be covered by a credible net-zero pathway.

Climate Urgency

The extent to which the pension manager is communicating the urgency and severity of the climate crisis to beneficiaries, stakeholders and the public, and the extent to which the pension manager’s language reflects an understanding of the urgency and severity of the climate crisis, its potential impacts on the fund’s assets, the financial and climate-related implications of its investment decisions, and the pension manager’s role in averting the worst outcomes of the climate crisis.

Climate Engagement

With Canadian pension managers frequently asserting their “engagement over divestment” approach, Shift analyzed the robustness of pension fund engagement programs, including:

Existence of clear climate-related expectations in plan documents (such as sustainable/ responsible investing policies, proxy voting guidelines for climate-related shareholder resolutions, guidelines and expectations of external managers);

Clear climate-related expectations for portfolio companies (such as commitment to net-zero emissions, prohibition of lobbying against climate action, tying executive compensation to emissions reductions, ending capital expenditures on fossil fuel expansion);

Establishment of time limits for companies and external managers to meet climate-related expectations, and communication of escalatory consequences for falling short of these expectations;

Examples or evidence of collaborative engagement on climate.

Climate Integration

A range of indicators which demonstrate the degree to which the pension manager has understood and embedded climate risks across the organization, including:

Disclosure of high-carbon exposure;

Quality and disclosure of climate scenario analysis;

Carbon footprinting and Task Force on Climate-Related Financial Disclosures (TCFD) reporting;

Board level climate expertise;

Board level fossil fuel entanglement;

Detail and contemporaneity of climate plan/strategy;

Compensation structure linked to climate targets;

Membership in a credible and accountable net-zero investor body such as NZAOA or PAII.

Fossil Fuel Exclusions

The existence of pension fund investment exclusions on high-risk fossil fuel companies, including oil, gas, coal, and related infrastructure.

Scoring Rubric

Download the scoring rubric and references.