2025 Canadian Pension Climate Report Card

Indigenous Rights Policies

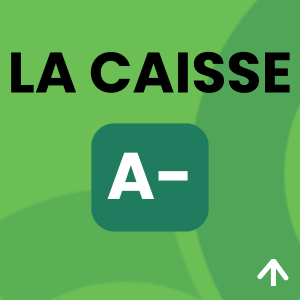

As Canada desperately tries to pretend it can go “elbows up” by doubling down on fossil fuels, Indigenous nations once again face pressure from a colonial system all too ready to push their rights aside. According to West Coast Environmental Law, the federal government’s Building Canada Act “shift[s] the focus of project reviews from whether they should proceed to how they should. The question of ‘whether’ is a critical aspect of the duty to consult and is fundamental to free, prior and informed consent” (emphasis added).

Investment policies that align with the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) and the principle of Free, Prior and Informed Consent (FPIC) are critical for ensuring that pension funds respect Indigenous rights and use their influence to prevent rights violations across their portfolios. Proxy voting guidelines create enforceability in public equities, demonstrating how a fund will exercise its shareholder power on issues related to Indigenous rights. However, pension funds additionally need policy to guide their expectations of private companies.

UPP and OPTrust are the only two Canadian pension funds in the 2025 Canadian Pension Climate Report Card whose proxy voting guidelines cite UNDRIP and contain clear, actionable commitments that state explicitly how the fund will vote on shareholder proposals in support of Indigenous rights.

BCI’s proxy voting guidelines state that its “business practices” align with UNDRIP and express support for “reconciliation and Indigenous inclusion.” PSP’s 2022 Annual Report pledged to support UNDRIP and FPIC, yet its proxy voting principles offer no clear indication of how the fund will vote on related shareholder resolutions. OMERS makes a gesture toward UNDRIP by encouraging companies to consider impacts on Indigenous communities and by committing internally to the principles of reconciliation, though its proxy voting guidelines stop short of UNDRIP alignment.

Finally, several major funds – AIMCo, CPPIB, HOOPP, IMCO, La Caisse and OTPP – have no disclosed investment policy or proxy voting guidelines referencing Indigenous rights.

As part of the 2025 Canadian Pension Climate Report Card, Shift identified the emissions reduction targets, additional climate targets, fossil fuel exclusions, fossil fuel investments and Indigenous rights policies of 11 Canadian pension managers. Indigenous rights policies appear below.

In 2025, OTPP became the first major Canadian fund to publicly release an Indigenous Action Plan. This document is primarily focused on internal policies and processes. On its own it is not an investment policy or proxy voting guidance, although it may help lay the groundwork for such.

A number of funds (AIMCo, HOOPP, IMCO, OMERS, OPTrust and UPP) are participants in Climate Engagement Canada (CEC), an investor collaborative with engagement criteria that include companies’ commitment to FPIC. The 2025 CEC benchmark found that consultation with Indigenous rightsholders is a significant gap for focus list companies.

Swedish fund AP2 provides an international example of recognizing and naming the links between its climate, biodiversity and deforestation efforts and Indigenous communities. The fund’s expectations of companies “include rights for Indigenous peoples and local communities, including the right to land and to free, prior and informed consent. AP2 has zero tolerance of threats and violence against human rights and environmental champions.”

The 2025 Canadian Pension Climate Report Card analyses, assesses and ranks the progress made by eleven of Canada’s largest pension managers and two international pension managers in their approach to climate risk and investment decisions as they relate to the climate crisis. The report is based on publicly available information to December 31, 2025. Cover image credit: Jim Peaco / National Park Service.