2025 Canadian Pension Climate Report Card

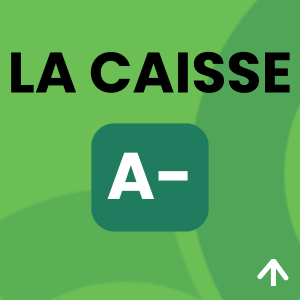

Caisse de dépôt et placement du Québec (La Caisse)

In 2025, La Caisse reaffirmed its big-picture climate commitments and outlined a significant shift in approach. After achieving portfolio decarbonization progress – meeting its interim emission reduction targets well ahead of schedule and completing its exit from coal and oil (extraction and refining) – the Quebec investment manager recognized that its own portfolio was decarbonizing faster than the real economy. Importantly, this recognition did not lead La Caisse to abandon its targets or backtrack on its shift away from polluting industries. Instead, La Caisse released in June 2025 a comprehensive 2025-2030 Climate Strategy and accompanying Transition Financing Framework which lay out the investment manager's updated approach to investing for real-world decarbonization.

La Caisse states it will both increase investment in climate solutions and shift its focus from its portfolio carbon footprint to its portfolio companies' decarbonization pathways and "climate maturity". While retaining its coal and oil exclusions and its 2030 target to reduce the emissions intensity of the portfolio, La Caisse will invest a total of $400 billion into various "climate action" categories, which include climate solutions investments and decarbonization investments. La Caisse's framework is backstopped by a “Do No Significant Harm” principle which “aims to prevent investments from unintentionally locking-in high-emission activities, undermining decarbonization goals or causing significant harm to other environmental and social objectives”.

In the years to come, La Caisse must demonstrate credible implementation of these strategies and its efforts to avoid high-carbon lock-in, including by disclosing science-based transition plans for its gas distribution and transmission assets.

The Quebec pension manager's climate-leading approach stands in stark contrast to that of Canada's national pension manager, CPPIB, which ended 2025 with an overall D in Shift's Report Card and faces a lawsuit over its handling of climate-related risk. Read more in our special section A tale of two pension managers.

Une version abrégée de cette analyse est disponible en français.

OVERALL SCORE

A-

Paris-Aligned Target

A-

Interim Targets

B+

Climate Urgency

A+

Climate Engagement

A-

Climate Integration

A-

Fossil Fuel Exclusions

B

La Caisse is the investment manager for 48 client depositors in Quebec, including public pension funds, insurance plans and other government funds. As of December 31, 2024, pension fund assets represent over 87% of its AUM. Its largest client, the Quebec Pension Plan, has 6.5 million contributors and beneficiaries.

Assets Under Management (AUM): $496 billion (June 30, 2025)

The 2025 Canadian Pension Climate Report Card analyses, assesses and ranks the progress made by eleven of Canada’s largest pension managers and two international pension managers in their approach to climate risk and investment decisions as they relate to the climate crisis. The report is based on publicly available information to December 31, 2025. Cover image credit: Jim Peaco / National Park Service.