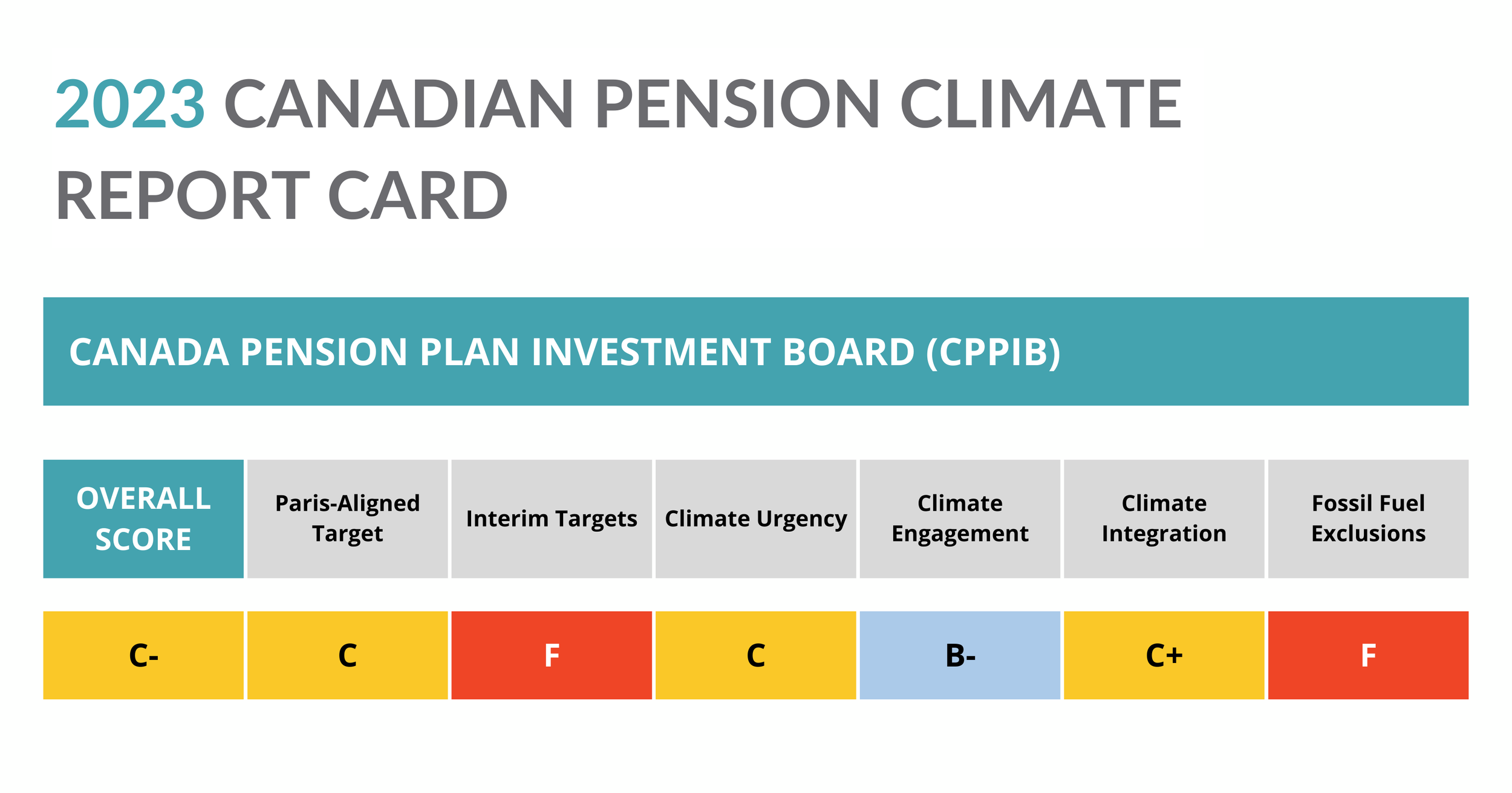

Canada Pension Plan Investment Board (CPPIB)

The 2023 Canadian Pension Climate Report Card assesses large Canadian pensions on their management of climate-related risks. The report is based on publicly available information to December 31, 2023.

CPPIB is the manager of the Canada Pension Plan (CPP). On behalf of over 21 million Canadians, CPPIB manages one of the largest investment funds in the world. All working and retired Canadian citizens outside of Quebec are members of the CPP.

Assets Under Management (AUM): $576 billion (September 30, 2023)

CPPIB is taking positive steps to assess the financial risks of climate change and navigate its portfolio through the energy transition. In 2021, CPPIB set a net-zero by 2050 emissions target which includes scopes 1, 2 and 3 emissions. The investment manager has developed a climate plan and issued several short reports on the energy transition and decarbonization. It has built specialized cross-organizational climate expertise and is using increasingly sophisticated tools and processes to generate value from the net-zero transition. CPPIB has smartly used its “Abatement Capacity Assessment Framework” to begin identifying profitable pathways for portfolio companies to decarbonize under CPPIB’s “decarbonization investment approach.” CPPIB is making large and growing investments in ”green and transition assets,” but remains a significant owner of fossil fuel assets, including those that are expanding oil and gas production.

CPPIB remains one of the only pension managers analyzed in this report that has yet to set interim portfolio emission reduction targets. CPPIB waffles on its communication of climate urgency, downplaying the systemic, existential nature of the climate crisis and the outsize role that it must play as a half-trillion dollar pension manager in keeping global temperature increases within safe limits. As detailed in this report’s Industry Capture: CPPIB is not shy about spouting oil industry talking points, the national pension manager continues to make regular public statements that celebrate Canada’s oil and gas industry and obfuscate the scientific imperative to rapidly phase out fossil fuels. CPPIB has repeatedly stated that it is opposed to “blanket [fossil fuel] divestment.”

2023 UPDATES

None

SUMMARY

CPPIB’s net-zero emissions by 2050 target stands out among Canadian pension fund targets because it explicitly includes scope 3 emissions. CPPIB’s definition of net-zero in its Investing in the path to net-zero document specifies reducing human-caused emissions “to as close to zero as possible” in addition to technological or nature-based solutions to remove carbon from the atmosphere (p.2). CPPIB also includes five Climate Change Principles that guide its commitment to net-zero (FY 2023 Annual Report, p.65).

CPPIB does not yet have interim targets, has not joined a credible and accountable Paris-aligned investor body, has not committed to follow the recommendations of the United Nations High Level Expert Group on Net-Zero Emissions Commitments of Non-State Entities, and has not specified the role of offsets in achieving net-zero. CPPIB’s position on offsets must be clarified, as the fund has made investments in carbon credits, includes the purchase of offsets as an emissions abatement option for companies in its Abatement Capacity Assessment Framework; and used certified offsets, allegedly generated from the avoidance of conventional logging, to claim that CPPIB’s operations were carbon neutral in 2023 (2023 Report on Sustainable Investing, p.28, FY 2023 Annual Report, p.67). CPPIB’s Chief Sustainability Officer (CSO) said in February 2023 that businesses should prioritize emissions reduction first and limit the role of offsets to high-integrity removal credits for hard-to-abate emissions that cannot be eliminated technologically or economically.

While the CPPIB’s net-zero commitment includes scope 3 emissions, currently only 6-7% of scope 3 emissions are being directly reported by CPPIB portfolio companies (2023 Report on Sustainable Investing, p.41).

2023 UPDATES

CPPIB remains one of the only Canadian pension funds analyzed in this report that does not have interim emissions reduction targets, and reported that its portfolio emissions are likely to increase in the near term.

CPPIB increased its investments in “green and transition assets” from $66 billion in 2022 to $79 billion in 2023, although it is unclear which particular assets CPPIB classifies as “transition” and whether they are actually aligned with net-zero.

DETAILS

Interim emissions reduction targets

CPPIB remains one of the only Canadian pension funds analyzed in this report that has yet to set interim emissions reduction targets. In a May 2023 interview with the Toronto Star, CPPIB’s CEO said that he believes interim targets create an incentive to sell off investments in high-emitting businesses, rather than spending the money it takes to reduce emissions. While CPPIB reported a reduction in its total carbon emissions and carbon footprint for non-government holdings in fiscal year (FY) 2023, the pension fund says its carbon emissions “will fluctuate over time” and that it “will only set targets when we have the confidence that they are feasible, achievable and aligned with our investment mandate” (Sustainable Investing: Approach, webpage).

CPPIB’s lack of interim targets is at odds with the Paris Agreement, as it neglects to account for the significant reduction in emissions that must be achieved by 2030 and makes it virtually impossible for Canadians to hold CPPIB accountable for progress toward its net-zero commitment. CPPIB says on its Our Net-Zero Commitment webpage that “we recognize that our portfolio’s emissions are likely to increase in the near term.” Temporary increases in portfolio emissions may be necessary and unavoidable, as pension funds can play a crucial role in deploying capital to help high-carbon, hard-to-abate companies and industries profitably decarbonize. Other pension funds, such as the Ontario Teachers’ Pension Plan, OMERS and Caisse de dépôt et placement du Québec (CDPQ) have acknowledged this emissions reduction challenge by creating specific transition asset portfolios, the emissions of which are accounted for separately from their broader portfolio’s emissions reduction targets. By doing the same, CPPIB could both enhance accountability toward achieving its net-zero commitment and enhance transparency of holdings that it considers to be “transition assets” that it is stewarding toward decarbonization.

CPPIB does not have targets for the proportion of AUM covered by a credible science-based decarbonization plan, nor does it have targets for successful climate engagement of owned companies.

Green and transition assets

CPPIB’s target for investments in climate solutions is notable: $130 billion in “green and transition assets” by 2030, as described on CPPIB’s Investing in the path to net-zero webpage. However, this target seems low in proportion to CPPIB’s projected AUM in 2030. CPPIB’s investments in green and transition assets represented 14% of AUM as of March 31, 2023. With CPPIB’s AUM projected to be $991 billion in 2030 (The Fund, webpage), the projected $130 billion investment in green and transition assets would amount to just 13% of AUM in 2030 — lower than the current proportion.

Between FYs 2022 and 2023, CPPIB increased its investments in green and transition assets from $66 billion to $79 billion. The one-year increase came from a combination of new investments, existing assets becoming green- and transition-eligible by taking actions such as achieving Science Based Targets initiative (SBTi) certification, and increased market valuations of eligible assets (FY 2023 Annual Report, p.66).

CPPIB bolstered its definition of “green and transition assets” in 2023, laying out clear conditions for differentiating “green” from “transition” and using revenue thresholds, asset types and decarbonization targets validated by reputable bodies like the International Capital Markets Association, Climate Bonds Initiative and SBTi (FY 2023 Annual Report, p.70).

But CPPIB’s incomplete reporting of these assets continues to obfuscate the extent of CPPIB’s holdings in oil, gas, coal and related infrastructure that do not have a credible pathway to decarbonization other than phase-out. Despite repeated requests, CPPIB has not disclosed a list of individual assets that it considers to be “green and transition.” This problem is further exemplified by CPPIB’s “Sustainable Energies” portfolio, which includes renewable energy, energy efficiency and conservation, and agriculture companies, but also oil and gas producers, pipeline companies, gas-fired power producers and carbon capture utilization and storage (CCUS) infrastructure for oil and gas. This lack of transparency and obfuscation makes the CPPIB’s claim of having $79 billion in “green and transition” assets impossible to verify.

2023 UPDATES

CPPIB is the only pension fund in this report to receive a lower score than last year in any category. In 2022, CPPIB received a B on Communication of Climate Urgency; in 2023, that score has been lowered to a C. While CPPIB staff sometimes indicate they understand the systemic and existential nature of the climate crisis, CPPIB executives regularly undermine the pension fund’s credibility by signaling they intend to prop up the primary cause of the crisis: fossil fuels.

DETAILS

CPPIB frequently notes in its reporting that climate change brings significant risks and opportunities and that the fund’s performance will be influenced by how well its portfolio companies and portfolios adapt “alongside the global economy on the path to net zero” (FY 2023 Annual Report, p.22).

Sample language from CPPIB’s Investment Beliefs:

“Climate change may well radically change economies and capital markets. Managing the risks and opportunities created by these and other broad factors is an integral part of CPP Investments’ investment processes, to ensure the Fund is structured to create value and growth that is sustainable over the long term” (Our Investment Beliefs, webpage).

There are also instances where CPPIB communicates the urgency and severity of the climate crisis. For example, a post by CPPIB’s Insights Institute in November 2023 says that “the risk of foregoing short-term pain will be long-term pain — a permanent cost to business, the planet and society. No one can afford to wait” (The profits of purpose: How can we shift from corporate commitments to concrete action on decarbonization?).

Sample language from CPPIB’s Managing Director and Head of Sustainability Integration in October 2023:

“Climate change is the greatest challenge of our lives, and there’s no time to waste, especially for institutional investors like us. This is a multilateral and interdisciplinary challenge to figure out, and it’s one we’re running out of time to tackle. It’s a business problem and it’s a business opportunity. We’re here to do the hard work, and we’re in such a great place to do it” (The biggest takeaways from Climate Week for investors, website post).

But CPPIB stops short of embracing the extent of its agency when it comes to decarbonization. An investor with CPPIB’s size and influence has the ability to hinder or contribute to international and domestic climate targets with its investment and asset management decisions and the signals it sends to markets and governments through its public communications. CPPIB even seems to downplay its influence and agency in accelerating emissions reductions, stating that “the financial sector cannot solve climate change alone” and “should never have been positioned that way” (The profits of purpose: How can we shift from corporate commitments to concrete action on decarbonization?). CPPIB does not clarify who stated that the financial sector alone could solve climate change. This spurious argument seems to attempt to shift responsibility away from the half-trillion-dollar asset manager, rather than rise to the occasion and acknowledge CPPIB’s significant influence and agency.

Unlike leading Canadian pension funds, CPPIB neglects to acknowledge double materiality (meaning that the climate impacts the fund, but also that the fund’s investment decisions and approaches to decarbonization impact the climate), as illustrated by this short sentence on its Our Net-Zero Commitment webpage: “As the world moves to net zero we are moving with it.”

Sample language from CPPIB’s Road To Zero Decarbonization Investment Approach Progress Report (p.5):

“To be clear, our net-zero commitment is made on the basis and with the expectation that the global community will continue to advance towards the goal of achieving net-zero greenhouse gas emissions by 2050. These advancements include the acceleration and fulfilment of commitments made by governments, technological progress, fulfilment of corporate targets, changes in consumer and corporate behaviours, and development of global reporting standards and carbon markets, all of which will be necessary for us to meet our commitment.”

So while there are examples of CPPIB communicating the urgency of the climate crisis, these are undermined by its passive approach to the transformative changes that are required to avoid dangerous global temperature increases that could undermine CPPIB’s mandate. CPPIB seems to shy away from the outsize role it must play in decarbonizing the real economy and helping Canada and the world achieve the Paris Agreement.

Propping up oil and gas is not part of CPPIB’s mandate

CPPIB executives’ persistent public statements on the fund’s willingness to prop up and prolong the life of the fossil fuel industry have contributed to CPPIB’s lower climate urgency score this year. (See Industry Capture? CPPIB is not shy about spouting oil industry talking points.)

CPPIB senior staff have also peddled the dangerous myth that Canada has a reputation for “responsibly-produced energy” (in the same year that Canadians learned that Imperial Oil leaked millions of litres of oil sands tailings and toxic chemicals into Alberta waterways from its Kearl oil sands project and then hid it from regulators, the public and downstream Indigenous communities for months). Canada produces some of the highest emissions-intensity oil in the world, and there is no such thing as responsibly-produced oil in the midst of a worsening climate emergency. CPPIB even went so far as to showcase its investments in the Alberta oil and gas industry and brag– on the same day as the opening of COP28 in Dubai– about one of its portfolio companies drilling the third most wells in Canada in the first nine months of 2023.

CPPIB veers away from its mandate when it tries to justify its support for the fossil fuel industry, saying that it sees its role as:

“avoiding sharp dislocations in specific industries and geographies” (2023 Sustainable Investing Report, pp.5-6);

“addressing the energy trilemma of security, affordability and sustainability;”

preserving public support for decarbonization; and

helping oil and gas companies reduce marginal operational emissions instead of rapidly phasing out production.

While the energy transition objectives stated by CPPIB staff may be worthwhile goals, they have little to do with the fund’s mandate, and suggest that CPPIB may be more concerned about responding to domestic political pressures than doing what is necessary to limit the worst impacts of climate change. It will be impossible for CPPIB to fulfill its mandate if the climate crisis spirals out of control, but CPPIB is neither speaking nor acting like it.

2023 UPDATES

CPPIB applied its Decarbonization Investment Approach to more than ten new and existing assets, and CPPIB reporting demonstrates that its Abatement Capacity Assessment Framework is achieving strategic value and emissions reductions for some portfolio companies.

CPPIB updated and strengthened its Proxy Voting Principles and Guidelines in 2023 to enhance climate-related expectations of companies and lay out escalatory steps CPPIB will take for companies that aren’t aligned.

SUMMARY

CPPIB’s score in this category reflects the decarbonization efforts it is applying to its companies, such as through its Decarbonization Investment Approach and application of its Abatement Capacity Framework, and its strengthening of its climate-related Proxy Voting Principles and Guidelines in 2023.

CPPIB says that, for the year ending June 30, 2023, its engagement contributed to material commitments and improvements on climate-related disclosures and practices at 22 companies, including dedicating a board committee or director responsible for climate oversight, enhancing details of a company’s decarbonization plan, or quantifying the financial impacts from climate-related risks and opportunities (2023 Report on Sustainable Investing, p.20).

However, CPPIB still falls short on climate engagement by:

Failing to set its own interim emissions reduction targets, which would signal to owned companies that they must demonstrate emissions reductions in line with a net-zero pathway;

Failing to require owned companies to have science-based net-zero targets and plans to achieve them;

Failing to signal to its owned companies or potential investees the imperative to decrease fossil fuel production and phase out fossil fuels;

Providing few details on how the fund escalates its engagement when companies fail to align on climate.

DETAILS

Expectations for owned companies

CPPIB expects companies to report on and disclose an appropriate governance structure for monitoring climate risks and opportunities, and have a credible transition plan to navigate them. CPPIB also says “sustainability-related factors” should be tied to company executive compensation, but stops short of setting an expectation for companies to incentivize emissions reduction through compensation (Sustainable Investing: Expectations, webpage).

However, CPPIB has not yet enshrined in its policies and proxy voting guidelines an expectation that companies have science-based net-zero targets and credible plans to achieve them, and has set no interim targets itself. Furthermore, CPPIB has set no expectation for its portfolio companies to stop directing capital expenditure toward increasing fossil fuel production, and no expectation that its portfolio companies end lobbying against climate action, either individually or through industry associations.

Decarbonization Investment Approach

CPPIB has developed a smart framework under its Decarbonization Investment Approach to help portfolio companies identify economical pathways to reduce emissions. CPPIB reported in 2023 on having applied its decarbonization investment approach to “more than ten existing and new assets spanning the real estate, infrastructure, agriculture, energy and tourism sectors,” which helped “develop transition plans that increase value in those companies and provide us with key learnings for other parts of our investment portfolio” (CPP Investments Publishes 2023 Report on Sustainable Investing, press release). The collective scope 1 and 2 emissions of the companies selected for the first cohort of companies under the decarbonization investment approach exceeded 3.5 million tonnes of CO2e, approximately 16.4% of the total emissions of CPPIB’s non-government holdings (Decarbonization Investment Approach Progress Report, p.5).

CPPIB’s Decarbonization Investment Approach Progress Report suggests that companies should take a sequential approach to identifying emissions-reduction opportunities that can be abated today using available and proven technologies. The approach should start with efficiency measures that reduce emissions without capital outlay, followed by decarbonization levers that reduce energy demand and add investments in renewable energy supply, and then a “probable category” for emissions which would likely be economically abatable over a 10-25 year period but which would require higher capital expenditures (p.11). Companies can then move on to a strategic discussion about how to address emissions that cannot be abated, either because it is technically not possible or very uneconomic. Options might include closure or shutdown of operations, reliance on technological moonshot solutions like CCUS or green hydrogen, or purchase of high-quality carbon offsets (pp.12, 13, 15, 20).

CPPIB did not explain that the only credible “decarbonization investment approach” for oil and gas companies is to phase out production, nor has CPPIB explained how it can profitably wind down the operations of its fossil fuel holdings while generating returns for Canadians. On the contrary, CPPIB instead makes regular public statements affirming its commitment to continued oil and gas production. (See Shift’s detailed analysis of CPPIB in its 2022 Canadian Pension Climate Report Card - CPPIB Analysis, pp.8-9, and Industry Capture? CPPIB is not shy about spouting oil industry talking points.)

CPPIB’s claims of limited influence to drive decarbonization

While CPPIB claims that it can effectively support decarbonization through its influence, active ownership, and avoidance of “blanket divestment” (Road To Zero Decarbonization Investment Approach Progress Report, p.5), comments from CSO Richard Manley indicate CPPIB is either taking a back seat or doesn’t know how to wield influence. For example, Manley said that CPPIB is “telling companies our expectations and leaving it to them to find the best ways to decarbonize” (The biggest takeaways from Climate Week for investors). And in an interview with Net Zero Investor, Manley said the fund was limited in influencing decarbonization, having available only the levers of portfolio design, security selection, governance rights and sometimes contractual terms.

This is a stunning admission from an influential pension manager and asset owner that repeatedly vaunts the need for engagement and active ownership while denouncing divestment and exclusions.

Direction given to partners and external managers

It is unclear what, if any, direction CPPIB gives to its General Partners and external managers on oversight of climate-related risk at owned companies. CPPIB’s Sustainable Investing reports allude to a sustainability-related due diligence questionnaire completed by General Partners and external managers which includes questions related to climate change (2023 Report on Sustainable Investing, p.13; 2022 Report on Sustainable Investing, p.5; 2021 Report on Sustainable Investing, p.16). But no information is provided regarding what these questions are or what guidance CPPIB subsequently provides to these partners.

Proxy voting

CPPIB updated its Proxy Voting Principles and Guidelines in February 2023 and transparently posts its individual proxy vote decisions in advance of companies’ annual meetings (Sustainable Investing: Proxy Voting, webpage). The updated principles and guidelines (p.11) include the consideration of business’ dependency on natural systems through specific commodities or operation locations and the potential impacts on companies’ long-term performance, an encouraging nod to the importance of biodiversity and nature protection (2023 Report on Sustainable Investing, p.14).

CPPIB says it generally supports shareholder proposals that “improve practices and disclosure on governance, strategy, risk management, performance metrics, and targets and opportunities related to climate change” (Proxy Voting Principles and Guidelines, p.12). CPPIB also affirms that “we expect boards and executives to integrate climate risks and opportunities into their strategy, operations and where material, disclosure” (p.21).

CPPIB’s Proxy Voting Principles and Guidelines now state that in some instances (“For companies that contribute the largest climate change risks in our public equities portfolio”), the fund will vote against accountable board members “where boards have failed to demonstrate adequate consideration and assessment of physical and transition-related impacts from climate change” (p.21-22). Based on the guidelines’ wording, however, CPPIB could still consider boards to have demonstrated “adequate consideration and assessment” without the company having a credible net-zero transition plan. CPPIB says that it will “consider” escalating its voting practice “in future years,” making it unclear how long CPPIB will allow companies to inadequately manage climate risks (p.21-22).

CPPIB also defers to company boards and management and generally opposes shareholder proposals that it deems to be overly prescriptive, even if the company’s climate plan lacks credibility, stating, “We respect that companies we invest in determine their own specific climate-related transition strategies” (p.21).

With the number of caveats in CPPIB’s Proxy Voting Principles and Guidelines and its position on “overly prescriptive” shareholder proposals, it is difficult to predict how CPPIB will vote on climate-related shareholder resolutions, or what it would take for CPPIB to consider a company uninvestable due to inadequate management of climate risks. In light of the climate crisis, CPPIB must set the expectation that companies commit to credible climate plans within a specified timeframe, and promptly vote against directors when this expectation is not met. CPPIB must also convey the expectation that its capital will no longer remain available to (i.e. that it will divest from) companies that fail to develop credible climate plans.

CPPIB reported that for the year ending June 30, 2023, it voted for climate-related reasons against the reappointment of the chair of the risk committee (or an appropriate equivalent committee) at 24 companies, resulting in votes against 70 directors. (For comparison, the British Columbia Investment Management Corporation (BCI) reported that in 2022, it voted for climate-related reasons against 261 directors within 197 companies, driven by BCI’s guideline to consider votes against directors for “a weak response to climate change risk or inadequate disclosure”). CPPIB also voted for 26 climate-related shareholder proposals that sought deeper disclosures on topics such as climate accountability, operational emissions management, asset portfolio resilience and public policy (2023 Report on Sustainable Investing, p.20).

When it comes to climate engagement of oil and gas companies in particular, there is little evidence that these companies are properly managing climate risks, or that CPPIB is withholding its support for directors. For example, an analysis of CPPIB’s 2023 proxy voting records shows that the pension manager voted to elect 95% of directors of major oil sands companies, even as they expand oil and gas production, lobby against climate policies and refuse to allocate capex to climate solutions.

Collaborative engagement

CPPIB is not a member of Climate Action 100+ or Climate Engagement Canada. While the fund is a member or contributor to various bodies (e.g. ESG Data Convergence Initiative, Investor Leadership Network), it is not clear if CPPIB is collaborating with other institutional investors on targeted climate-related engagement of owned companies.

Policy engagement

CPPIB regularly provides comments on sustainability-related public and government consultations, such as to the U.S. Securities and Exchange Commission, International Sustainability Standards Board (ISSB) and other bodies setting standards and policies for climate risk reporting (Sustainable Investing: Influence, webpage). But CPPIB must become more vocal and assertive in its advocacy to help ensure that governments in Canada and around the world are developing and implementing stringent and durable laws, policies and regulations that accelerate emissions reductions in line with the Paris Agreement.

2023 UPDATES

CPPIB released an actuarial report by Canada’s Office of the Superintendent of Financial Institutions (OSFI) that included a climate scenario analysis of the impact of three different scenarios on the CPP.

CPPIB created a new framework to assess physical and transition impacts on its private real estate holdings in 2023.

Accountable Paris-aligned membership

CPPIB is not a member of any accountable and credible Paris-aligned investor body.

Transparency and disclosure of holdings

CPPIB discloses its investments and their valuation across asset classes through its website. CDPQ and BCI are the only other pension managers with investment disclosure that approaches that of CPPIB.

Transparency and disclosure of climate risk

When asked by beneficiaries in a formal letter in 2021, CPPIB did not provide a list of high-carbon assets or assets that are aligned with 1.5°C. CPPIB continues not to disclose a list of assets it considers to be aligned with climate safety despite multiple repeated requests from contributors and beneficiaries in 2022 and 2023.

CPPIB’s reporting of its asset classes in its FY 2023 Annual Report makes it virtually impossible to determine how exposed the fund is to fossil fuels. “Sector Diversification” reporting of CPPIB’s Active Equities (p.55), Credit Investments (p.57) and Private Equity (p.59) includes no breakdown by “energy” or “oil and gas,” but only an “Other” category that could include significant fossil fuel holdings (p.55). CPPIB’s reporting of its “Real Assets” portfolio includes a “Sector Diversification” breakdown that includes “Power Generation,” “Utilities and Other Infrastructure,” and “Energy and Resources,” but it is unclear where oil, gas and related infrastructure fall within these reporting categories (pp.61-62). As discussed above, CPPIB has not disclosed which of its assets it considers to be “green” and “transition”, while its “Sustainable Energies” portfolio appears to include fossil fuel companies.

In its 2023 Report on Sustainable Investing, CPPIB reports that approximately 51% of the fund’s total emissions are directly reported by portfolio companies. CPPIB expects this percentage to increase as climate-related reporting disclosures improve. CPPIB also reported that only 6-7% of the fund’s scope 3 emissions are directly reported by portfolio companies, so scope 3 emissions are not included in its portfolio emissions reporting (p.41). Considering that CPPIB’s net-zero commitment explicitly includes scope 3, it is concerning that the CPPIB has not yet reported a scope 3 emissions figure and that such a small fraction of scope 3 emissions are directly reported to the fund by portfolio companies.

Scenario Analysis

While CPPIB’s 2022 TCFD reporting on scenario analysis is high-level, the disclosure is blunt in describing potential losses to the fund, and demonstrates that both a business-as-usual scenario (i.e. regulatory inaction on climate) and delayed regulatory action scenario result in an annualized negative impact in the double digits (p.4). Similarly, CPPIB’s FY 2023 Annual Report includes reporting on scenario analysis that concluded that a business-as-usual scenario where decarbonization efforts are less successful could lead to a potential annual impact to the fund’s market value by up to 13% in the next 30 years, largely driven by physical climate risks. In a scenario where climate policy actions are more heavily concentrated in years after 2030 through abrupt adoption of stricter mitigation efforts to limit warming to no more than 2°C, CPPIB forecasts that its market value could be negatively impacted by up to 11% per year in the next 10 years, largely driven by transition risks associated with the sharp fall in GDP and knock-on consequences for consumer demand (FY 2023 Annual Report, p.66). And a November 2022 actuarial report from the Office of the Superintendent of Financial Institutions (OSFI), which CPPIB released with its annual report in May 2023, included an analysis of how three different climate scenarios might impact global GDP growth and the CPP, including an “orderly transition,” “disorderly/delayed transition,” and “failed transition” scenario. OSFI’s scenario analysis showed that minimum contribution rates to the CPP would be significantly higher by 2034 in a failed transition scenario compared to an orderly transition.

With this information in hand, which clearly shows that delayed action on climate will be detrimental to the fund, it is astounding that CPPIB continues to invest in fossil fuel expansion. Every action CPPIB and its portfolio companies take to expand and prolong the use of oil and gas brings a delayed or disorderly transition closer to fruition, increasing the likelihood of double-digit losses to the fund.

CPPIB has also implemented a “Climate Change Strategy Security Selection Framework” which considers “high-physical-risk scenarios” (more than 4°C of global temperature increase) and “high-transition-risk scenarios” (less than 2°C of warming) (FY 2023 Annual Report, p.21). CPPIB reports that it is supplementing its Climate Change Security Selection Framework with a proprietary net-zero scenario framework (2023 Report on Sustainable Investing, p.11).

Finally, CPPIB created a new framework to assess physical and transition impacts on its private real estate holdings in 2023, in order to assess risks, identify for further engagement those assets most exposed, and inform future investment decisions (2023 Report on Sustainable Investing, p.12).

Climate risk expertise

In August 2023, CPPIB’s CEO told Responsible Investor that the fund’s sustainable investing group included 22 staff members, but his goal was to ensure the entire organization has “the relevant fluency in sustainability to integrate it where material across investment lifecycles.” The sustainable investment group arranges secondments in order to bring their sustainability expertise to other departments. CPPIB also strengthened its climate-related governance in 2023, including enhancing the accountabilities of the CSO and making the Sustainable Investing Committee into a senior management sub-committee of its Investment Strategy and Risk Committee (2023 Report on Sustainable Investing, p.9). CPPIB sent a delegation of five staff to NYC Climate Week in September 2023 (The biggest takeaways from Climate Week for investors) and organized a Sustainable Energies Group Leaders Summit in fall 2023 that brought together executives from CPPIB portfolio companies with energy sector leaders (Sustainable Energies Group Leaders Summit).

Board climate expertise and/or fossil fuel entanglement

No directors on the CPPIB board are identified as having climate expertise. CPPIB’s “Board composition matrix” does not include climate risk expertise in its key areas of skills and experience. Board professional development topics included climate change reporting in FY 2023 (FY 2023 Annual Report, p.82).

As of December 31, 2023, four of 12 CPPIB Board members, or one-third of the board, have current ties to fossil fuel companies.

• Judith Athaide sits on the board of directors of Kiwetinohk Energy, which produces and processes fossil gas in the Montney and Duvernay formations in Alberta and B.C. and operates gas-fired power generation and renewable energy projects in Alberta.

• Ashleigh Everett is the current President, Corporate Secretary and Director of Royal Canadian Securities Ltd., which owns Domo Gasoline Corp, a gasoline retailer with over 90 stations throughout Central and Western Canada.

• Sylvia Chrominska sits on the board of directors of Wajax Corp, an industrial supplier of equipment for mining and oil extraction, among other industries.

• Barry Perry sits on the board of Capital Power. Capital Power owns and operates two coal plants and 12 fossil gas power plants, as well as a growing portfolio of wind and solar projects, is planning to expand and build gas plants in Ontario, and agreed to buy two new gas plants in the United States in November 2023. Mr. Perry also serves on the board of Royal Bank of Canada, which was the largest financier of fossil fuels in the world in 2022.

Executive and staff compensation and climate

CPPIB provides no specific information regarding whether or not executive or staff compensation is tied to the achievement of climate-related targets. CPPIB’s 2023 Report on Sustainable Investing states that “Sustainability-related considerations are incorporated into employee objectives and compensation structures across the Fund” (p.9). Here CPPIB falls behind not only CDPQ and Ontario Teachers’, which are climate leaders among Canadian pension funds, but also behind OMERS and the Healthcare of Ontario Pension Plan, both of which did not release climate plans until 2023, and OPTrust, which released an updated climate strategy in 2022. These five funds have all specified a link between climate targets and compensation.

2023 UPDATES

The CPPIB has not yet acknowledged the imperative to phase out fossil fuels, nor has it placed limits on fossil fuel investment.

On the contrary, in 2023 CPPIB financed fossil fuel expansion and increased its exposure to the oil and gas sector by buying a 49% stake in California’s second largest oil producer, while its portfolio companies continued to build new gas plants and acquire new fossil fuel production assets and its investment in a private equity fund financed new LNG export terminals.

DETAILS

No exclusions.

CPPIB is lagging behind other institutional investors in recognizing the risks that fossil fuel investments pose to its portfolio. Investors with nearly US$42 trillion in AUM, including several other Canadian pension funds, have at least a partial exclusion on fossil fuels, with new divestment commitments announced regularly. CPPIB must get over what appears to be an ideological commitment to fossil fuel investment and protect the retirement savings and climate future of Canadians by placing an immediate exclusion on new investments and releasing a timeline and plan for the managed phase-out of its existing fossil fuel assets.

CPPIB’s 2023 Sustainable Investing Report and accompanying documents and webpages rejected fossil fuel divestment 11 separate times, and no CPPIB documents contain any sort of exclusion on new investment in coal, oil, gas or related infrastructure. CPPIB’s “Climate Change Principles” also explicitly reject “blanket divestment” (Policy on Sustainable Investing, p.4). CPPIB’s ongoing support for the fossil fuel industry even raises concerns that the fund intends to grow its investments in oil and gas. For example, CPPIB CEO John Graham told a Calgary audience in November 2023 that the fund “will continue to look for additional investment opportunities in Alberta, in both traditional and renewable energy”. In 2023 CPPIB financed fossil fuel expansion and bought a 49% stake in California’s second largest oil producer.

CPPIB’s CSO claims that “consensus has consolidated around the belief that the financial system should be empowered to finance the transition to a low-carbon future rather than mobilized to pursue a divestment agenda” (2023 Sustainable Investing Report, p.5). This is a false binary, as divestment and exclusions are simply part of a robust program of active ownership, engagement and climate risk management.

While CPPIB publicly commits to continue investing in fossil fuels, its Sustainable Investing Policy states that the fund may “choose not to pursue or maintain investments” (i.e. exclude or divest) for reasons including sustainability-related issues undermining long-term competitiveness, brand and reputation considerations from sustainability-related factors, and legal considerations” (p.6). Fossil fuel companies meet all three criteria, as other investors have concluded.

Yet while the Sustainable Investing Policy clearly articulates exclusion or divestment criteria, CPPIB continues to forswear divestment, as in its 2023 Sustainable Investing Report: “While we may choose not to invest in particular companies on a case-by-case basis reflecting their fundamental investment case, we will not engage in blanket divestment that excludes investment in entire sectors of the economy” (p.10).

CPPIB’s unwillingness to institute fossil fuel exclusions or phase-out commitments appears to be ideological. It is certainly not supported by science, which shows that fossil fuel production must be rapidly phased down to limit global temperature increase to 1.5°C. Nor is it consistent with CPPIB’s mandate to achieve a maximum rate of return without undue risk of loss. CPPIB’s rejection of divestment seems to be more about palliative care for an industry in terminal decline than about fulfilling its mandate, as exemplified by statements such as, “the optimal green transition is one that removes the most GHG emissions from operations, while pursuing opportunities that create value for businesses and stakeholders and avoiding sharp dislocations in specific industries and geographies” (Letter from the Chief Sustainability Officer, 2023 Sustainable Investing Report 2023, p.6).