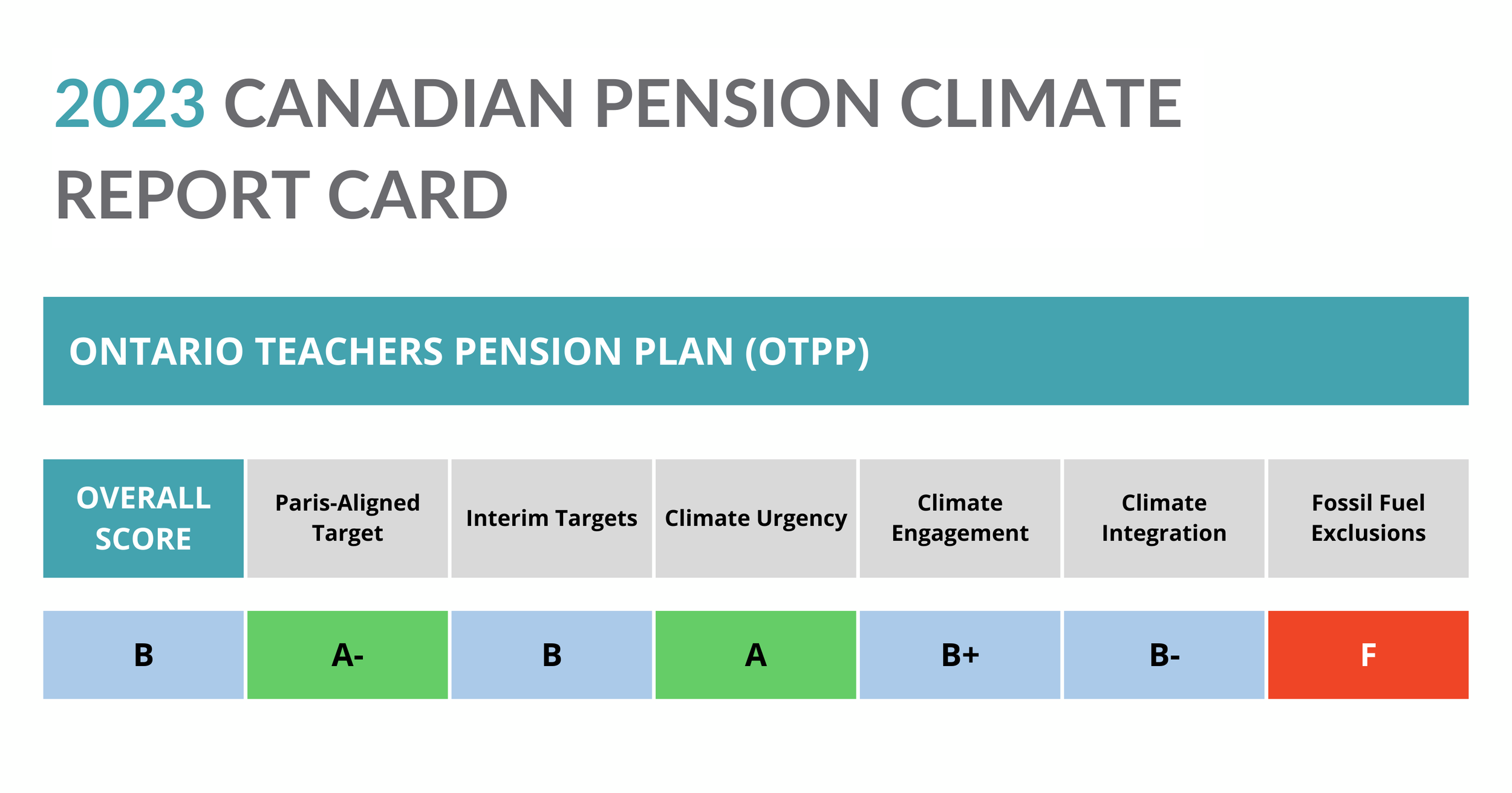

Ontario Teachers’ Pension Plan (OTPP)

The 2023 Canadian Pension Climate Report Card assesses large Canadian pensions on their management of climate-related risks. The report is based on publicly available information to December 31, 2023.

The OTPP is Canada’s largest single-profession pension plan. It administers a defined benefit pension plan for 336,000 active and retired teachers across 170 organizations including public school boards and private schools throughout Ontario.

Assets Under Management (AUM): $249.8 billion (June 30, 2023)

While the OTPP remains a climate leader among Canadian pension funds, there is little to report in 2023 on the OTPP’s progress toward its net-zero commitment. OTPP is aligning its climate strategy reporting with its annual reporting process, and therefore did not release a Responsible Investing Report or Climate Strategy Update in 2023.

In 2023, the OTPP:

Reported reducing the portfolio’s emissions intensity by 32% below 2019 levels (en route to a 45% by 2025 reduction target and a 67% by 2030 reduction target).

Increased green investments to $34 billion.

Updated and strengthened its climate-related Proxy Voting Guidelines, although a snapshot of climate-related votes raises questions about how OTPP is following its own guidelines.

Added a Board Director who simultaneously sits on the boards of four fossil fuel companies.

Published briefings/whitepapers on its renewable energy, sustainable buildings and electricity infrastructure assets, but reported virtually nothing about its significant fossil fuel assets.

Did not report on any allocation of its $5 billion for decarbonizing “High Carbon Transition Assets”.

The OTPP’s interim emissions intensity reduction targets are ambitious, although the fund is planning to align its portfolio with a “2°C or lower pathway” emissions trajectory (2022 TCFD Report, p.3) rather than 1.5°C. The OTPP reported in 2023 that it had increased the proportion of assets that are reporting emissions, but it has not yet started reporting the portfolio’s scope 3 emissions. Despite the worsening climate emergency, the OTPP has not excluded new investment in fossil fuels and falsely claims that fossil gas is a “transition fuel.”

We look forward to the OTPP providing a comprehensive update to its Climate Strategy in 2024.

2023 UPDATES

No updates

DETAILS

The OTPP set a target in January 2021 for net-zero portfolio emissions by 2050 and announced ambitious emissions intensity reduction targets in September 2021. The OTPP defines net-zero as “a balance of emissions released into and removed from the atmosphere” (Climate Change FAQ, p.1) and states in its 2022 TCFD Report that its objective is to “achieve a net-zero emissions portfolio by 2050, following a trajectory aligned with a 2°C or lower pathway” (p.3). This falls short of an objective to align its portfolio with 1.5°C, which would mean lower climate-related risks for the pension fund and a more stable world for plan members.

The OTPP’s climate strategy is “deeply rooted in driving real-world emissions reductions,” according to an undated interview with OTPP’s former Chief Investment Officer on OTPP’s website (Q&A with our CIO Ziad Hindo). The fund has not formally stated what role, if any, carbon offsets would play in achieving its net-zero target and real-world emissions reduction objectives.

But the OTPP’s Senior Managing Director of Natural Resources told AgriInvestor in September 2023 that:

“We strongly believe that companies should follow the mitigation hierarchy and prioritize abatement opportunities within their own operations and supply chains. Having said that, we do see an important role for high-quality carbon credits to bridge the gap to a lower emissions pathway while governments and industry make concerted effort and meaningful investment towards this objective. Over the long term, high-quality carbon credits will be critical to neutralizing residual, hard-to-abate emissions from certain sectors.” The OTPP should place a strict limit on the role of carbon offsets in both its own net-zero commitment and the net-zero commitments of portfolio companies.

The OTPP has not joined an accountable and credible Paris-aligned investor body such as the Net Zero Asset Owner Alliance or the Paris Aligned Asset Owners, nor has it committed to follow the recommendations of the United Nations Secretary-General’s High Level Expert Group on Net-Zero Emissions Commitments of Non-State Entities. The OTPP’s net-zero commitment does not specifically account for its portfolio’s scope 3 emissions, unlike that of some of its peers, such as the Canada Pension Plan Investment Board.

2023 UPDATES

Reduced portfolio emissions intensity by 32% below a 2019 baseline (as of December 31, 2022).

Increased green investments to $34 billion (as of December 31, 2022), on the way to a goal of $50 billion by an unspecified date.

Increased the proportion of direct private portfolio that is covered by emissions reporting to 88% (as of December 31, 2022), up from 37% in 2019.

DETAILS

The OTPP (along with the Caisse de dépôt et placement du Québec) has some of the strongest interim targets among Canadian pension funds, but still needs to pair its emissions intensity targets with targets for absolute emissions reduction. As described in the OTPP’s 2022 Annual Responsible Investing and Climate Strategy Report, the OTPP’s targets include:

Emissions reduction

Commitment: reduce the carbon intensity of the portfolio by 45% by 2025 and 67% by 2030, using a 2019 baseline (p.12).

As of December 31, 2022, the OTPP reduced portfolio emissions intensity by 32% below a 2019 baseline, unchanged from 2021 "due to an increase in both market value and absolute emissions of its portfolio carbon footprint” (2022 Annual Report, p.73). The OTPP also reported that it reduced its portfolio’s absolute emissions by 3% since 2019 (2022 Annual Report, p.73), but has not yet set short-, medium-, or long-term targets for absolute emissions reductions.

Proportion of portfolio emissions covered by science-based net-zero plans and targets

Commitment: ensure two-thirds of the portfolio’s carbon emissions are covered by credible, science-based net-zero plans and targets (including scope 3 when material) by 2025, and 90% are covered by such plans by 2030 (2022 Annual Responsible Investing and Climate Strategy Report, p.15).

The OTPP said that a company’s transition plan and target will be considered “credible” if it’s “aligned with a science-based methodology” (2022 TCFD Report, p.4), but did not provide an update on progress toward this target in 2023.

Green investments

Commitment: increase “green investments” to $50 billion, although the OTPP has not provided a target date (2022 Annual Responsible Investing and Climate Strategy Report, p.4).

The OTPP reported in 2023 that its green assets reached $34 billion as of December 31, 2022 (2022 Annual Report, p.40).

Decarbonizing high carbon transition assets

Commitment: invest $5 billion in “high carbon transition assets” (HCTAs), defined as “very high-emitting companies with credible decarbonization plans that we believe we can accelerate through our capital and expertise,” with a focus on power generation, heavy industry, mining and transportation, and with the intention of accelerating their path to decarbonization (2022 Annual Responsible Investing and Climate Strategy Report, p.16). HCTAs will not be covered by OTPP’s interim emissions reduction targets, but will be accounted for under the fund’s commitment to net-zero by 2050 (2022 Annual Report, p.40). The OTPP did not report on any allocation to HCTAs in 2023.

2023 UPDATES

No updates

DETAILS

The OTPP continues to acknowledge the urgency of the climate crisis, embraces its role as an investor to influence the trajectory of decarbonization, and centres climate in its investment strategy. The OTPP even acknowledges, on its webpage Four takeaways from our 2023 Portfolio Company Leaders Conference, that the world is experiencing rapid changes, including “the end of the stable climate regime that lasted 100,000 years.”

Sample language from OTPP’s CEO, April 2023 AGM (p.5):

“We see [our commitment to climate] as a strategic imperative to delivering pensions over the long term. The plan has a multi-faceted climate strategy that is rooted in driving tangible emission reductions.”

Sample language from OTPP’s CEO, 2022 Annual Report (p.13):

“As an active and engaged investor, we have an opportunity to play a role in addressing some of the biggest environmental and social challenges of today to deliver value over the long term. In that regard, we are making significant efforts to help tackle climate change and aid the transition to a low-carbon economy. We have a multi-faceted strategy that involves investing in green and transition assets, helping our portfolio companies decarbonize, issuing green bonds to support their funding and more.”

2023 UPDATES

An analysis of select OTPP climate-related votes raised questions about how it is applying its own Proxy Voting Guidelines.

The OTPP did not release a Responsible Investing Report or Climate Change Strategy Update in 2023; related updates are expected to be included in the OTPP’s annual report in 2024.

SUMMARY

The OTPP’s interim targets signal the fund’s expectation that its owned companies move toward Paris alignment. The OTPP is committed to having two-thirds of portfolio emissions covered by credible, science-based net-zero plans and targets by 2025, and 90% covered by 2030. The fund specifies that targets should include scope 3 emissions when material (2022 Responsible Investing and Climate Strategy Report, p.15) and that it is developing a more complete accounting of portfolio company scope 3 emissions (2022 Annual Report, p.41). The OTPP improved the accuracy of its reported emissions by increasing emissions reporting (rather than estimating) from its direct private portfolio, going from 37% reported emissions in 2019 to 88% in 2022 (p.32).

The OTPP’s reports and guidelines show that the fund has an engagement process supported by tools and resources for portfolio companies, and that the OTPP is willing to escalate if companies are unresponsive. The fund’s Responsible Investing Guidelines say that ESG engagement in general (not climate specifically) includes specific, measurable, achievable, relevant and timebound objectives, with progress monitored regularly. For owned companies at which OTPP has board representation, a designated director is responsible for escalating ESG issues to the OTPP (p.6).

To support climate engagement, the OTPP has created a “decarbonization playbook” to guide portfolio companies in which it has “significant stakes (minority or control)” to develop a “Paris Aligned Reduction Target” (PART) with a credible plan to achieve net-zero by 2050. The PART and decarbonization playbook, described in the 2022 Responsible Investing and Climate Strategy Report (p.15) and the OTPP’s 2022 Annual Report (p.39), includes sections on board and management education, carbon footprinting, decarbonization levers, target-setting, and guidance on what to include in a credible net-zero plan.

On the escalation side, new OTPP investments without Paris-aligned targets have a two-year grace period within which they must set emissions reduction targets (2022 Responsible Investing and Climate Strategy Report, p.15). The OTPP does not say what consequences a company faces if the company does not set a target within this window. But the Responsible Investing Guidelines state that the OTPP’s ESG escalation process (general, not climate-specific) for public companies “includes voting against directors, executive participation in engagements, potential to use shareholder proposals and legal action, and finally divestiture” (p.6).

The OTPP’s engagement process would be stronger if the fund was more willing to publicly use its significant clout. The OTPP’s Responsible Investing Guidelines state, “A public approach to company engagement can be viewed as confrontational and be counter-productive, however, we will make our views known if a company is unresponsive or the situation is such that a public response is appropriate and/or more effective” (p.6). To Shift’s knowledge, the OTPP has not yet used this tactic to drive company action on climate change.

DETAILS

Expectations for owned companies

As per the fund’s interim targets, the OTPP expects a growing number of portfolio companies to have credible net-zero plans. Companies in which the OTPP has significant stakes may be provided with resources (e.g. decarbonization playbook, HCTA allocation) to achieve this.

For public companies, the OTPP’s 2022 Responsible Investing and Climate Strategy Report sets out strong expectations, including “implementation of credible net-zero transition plans that include a commitment to achieve net zero on or before 2050, near-term and science-based emissions reduction targets, and details on how they will achieve their targets,” as well as board accountability for climate change oversight (p.25).

Direction given to external managers

The OTPP’s 2022 Responsible Investment Guidelines state that external managers and general partners undergo an ESG policy and practice review. While the OTPP states it has “ongoing dialogue and sharing of leading practices” (p.5) with these partners, it is unclear what specific direction the OTPP provides on climate-related targets and expectations. In the OTPP’s 2022 Responsible Investing and Climate Strategy Report, the fund noted it has targeted partnerships with funds that have “climate-driven mandates” and added two new such managers in 2022 (p.17). The OTPP’s 2022 Annual Report and 2022 TCFD Report provided no updates on the fund’s climate-related expectations of external managers.

Proxy voting

The OTPP’s approaches, expectations and guidelines related to climate change are the same in its 2023 Proxy Voting Guidelines as they were the previous year. The guidelines specify that the OTPP expects companies to:

report based on recommendations made by the International Sustainability Standards Board (ISSB) and the TCFD;

include the metrics being tracked, targets associated with those metrics and the performance against those targets;

disclose their carbon footprint and explain how they are calculating their footprint;

conduct scenario analysis, including a net-zero scenario; and

provide short-, medium-, and long-term carbon/greenhouse gas emissions reduction targets and their progress towards those targets (pp.11-12).

The OTPP’s 2023 Proxy Voting Guidelines say that the OTPP will “consider” not supporting individual directors, chairs or committees when it determines that a board is not effectively overseeing climate-related risks. The Guidelines specify that company boards should have a “readily evident and easily understood” role in oversight of climate risk (p.11). The pension manager expects climate-related disclosure aligned with the TCFD (including metrics, targets, and performance) and credible scenario analysis (including a net-zero aligned scenario) (p.11). According to the guidelines, the OTPP will “typically support shareholder proposals that we believe strengthen the company’s climate change-related practices” (p.32).

Climate-related shareholder proposals the OTPP “will typically” support include:

improving climate change governance practices and board oversight;

the completion of a materiality assessment regarding company’s climate exposure with the intention of having the company better understand its climate risks;

the stronger disclosure of decision-useful climate related information;

the monitoring and management of climate change related risks and opportunities;

additional action by the company to better align its business with the transition to a low-carbon economy aligned with the Paris Agreement, including net-zero initiatives; and

the alignment of reporting with the recommendations of the ISSB and TCFD (p.32).

It is notable that the OTPP’s Proxy Voting Guidelines address corporate political activities, expenditures and trade associations. This sets the expectation that companies’ public statements be aligned with their actions, and that political activities, expenditures and trade associations “enhance long-term value for shareholders and stakeholders.” Otherwise, the OTPP “expect(s) a cogent explanation as to why the misalignment exists and the plan for remedying the contradiction.”

The OTPP says it will “typically support proposals seeking to establish or improve oversight from the board on political expenditures (quantum) and activities, including policy and procedural reviews, and taking industry and peer comparisons into consideration. We also expect companies to provide regular disclosure on political expenditures, rationales for political expenditure, dues to trade associations, and rationale for association dues paid” (p.33).

However, the OTPP’s guidelines should go further by expressing an expectation that companies must not lobby against climate policies and must depart from industry associations that oppose climate action. The OTPP should be ready to bring forward shareholder resolutions, vote against directors or divest if these expectations are not met.

While the OTPP’s Proxy Voting Guidelines appear relatively strong, an analysis by Investors for Paris Compliance of the 2022 proxy voting patterns of Climate Action 100+ signatories raises questions about whether the OTPP is voting in line with its own guidelines. The OTPP voted in favour of climate-related shareholder resolutions less than one-third of the time in the study of 23 North American resolutions. Similarly, Shift’s analysis of select climate-related proposals at bank and oil company AGMs found that the OTPP voted against three proposals at the Royal Bank of Canada, calling them “duplicative” or “overly prescriptive.”

Collaborative engagement

The OTPP is a member of Climate Action 100+ and stated in its 2021 Responsible Investing and Climate Change Report that its Climate Action 100+ engagements resulted in 35 companies committing to “enhance their climate change practices” and 26 companies to making “commitments on net-zero targets” in 2020 (p.20). The OTPP’s 2022 Annual Report and 2022 TCFD Report provided no updates on the fund’s Climate Action 100+ engagements.

Policy engagement

The OTPP occasionally provides comments on sustainability-related public and government consultations, such as to the ISSB and other bodies setting standards and policies for climate risk reporting. But the OTPP must become more vocal and assertive in its advocacy to help ensure that governments in Ontario, Canada and around the world are developing and implementing stringent and durable laws, policies and regulations that accelerate emissions reductions in line with the Paris Agreement.

2023 UPDATES

The OTPP did not release a Responsible Investing Report or Climate Strategy Update in 2023.

While the OTPP issued reports and updates about its investments in renewable energy, sustainable buildings and electricity infrastructure assets, Shift identified no substantive reporting in 2023 regarding the fund’s significant fossil fuel assets. The OTPP has not disclosed an inventory of its fossil fuel assets despite repeated requests from plan members

A Director who joined the OTPP Board in 2023 concurrently serves on the boards of four fossil fuel companies.

DETAILS

Accountable Paris-aligned membership

The OTPP is not a member of any accountable and credible Paris-aligned investor body.

Transparency and disclosure of holdings

The OTPP issues press releases regarding major investments or sales of assets and provides a full list of privately owned companies (without valuation) on its website. Its website also lists all investments in which the OTPP holds a position of $200 million or more.

Transparency and disclosure of climate risk

Despite being asked repeatedly by beneficiaries over a number of years, the OTPP has still not provided an inventory of its fossil fuel investments. The OTPP’s two most recent Annual Reports categorize investments as “energy,” “energy and power” and “power generation” without distinguishing between fossil fuels and renewables. This makes it impossible to quantify the OTPP’s fossil fuel investments, or compare these investments with previous years, when the OTPP broke down portfolios by sectors that included “oil and gas” and “gas transmission and distribution.”

The OTPP has recently published three special reports: Investing in Sustainable Buildings, Power Shift (focused on electricity transmission and distribution infrastructure) and A Renewed Energy (focused on renewable energy). The fund’s annual and sustainable investing reports also feature glossy case studies of investments in climate solutions. But in 2023 the OTPP was silent on its significant fossil fuel assets and how it proposes they fit with the fund’s net-zero commitment. This silence is especially concerning given that these assets face outsize transition risk and pose risks to the stability of the climate and therefore OTPP members’ retirement security.

Carbon emissions reporting

The OTPP increased the proportion of its direct private portfolio that is covered by emissions reporting to 88% by the end of 2022, up from 37% in 2019 (2022 Annual Report, p.8).

Scenario analysis

The OTPP’s 2022 TCFD Report does not provide a more up-to-date climate scenario analysis than the one conducted in 2018 (referenced in 2022’s report). The scenario framework used that year did not include a 1.5°C-aligned scenario, stating that “The organization’s objective is to achieve a net-zero emissions portfolio by 2050, following a trajectory aligned with a 2°C or lower pathway.” The report says that the OTPP expects to have to manage physical climate risks in the near and long term, but that “We view the bigger risk to the resilience of our strategy as a scenario in which the world takes a divergent pathway – one that is not moving towards net zero” (p.3).

Board climate expertise and/or fossil fuel entanglement

The OTPP is the only fund examined in this report that specifically identifies board members with climate-related experience, qualifications or expertise. Four Board members are identified as such in the OTPP’s 2022 Annual Report’s Board Skills Matrix (p.49). Board member Monika Federau previously sat on the Advisory Board of the Intact Centre for Climate Adaptation. Board member Cindy Forbes “laid the foundation for meaningful advances in sustainability reporting and carbon reduction targets” at a large life insurance company. It is unclear from their OTPP biographies what climate-related experience or qualifications Board members Gene Lewis and George Lewis bring to their roles.

The 2022 Annual Report also notes that “the importance of mitigating climate change and the impact our investments and operations have on the environment remained an area of focus on every board meeting agenda” (p.11).

One member of the OTPP’s 11-person Board is concurrently a director at four fossil fuel companies. Deborah Stein, whose OTPP term began on January 1, 2023, serves as a Director of Parkland Corporation, NuVista Energy and Trican Well Service. Ms. Stein is also listed as a Director at Washington Gas. According to her OTPP bio, Ms. Stein was formerly CFO of AltaGas and previously worked at TC Energy. Following the announcement of Ms. Stein’s appointment in September 2022, a group of working and retired teachers called for the retraction of the appointment over potential conflicts of interest between Ms. Stein’s oversight of climate risk for the OTPP and concurrent legal obligations to fossil fuel companies.

Executive and staff compensation and climate

According to the OTPP’s 2022 TCFD Report, climate-related objectives are part of the annual scorecard used to measure performance and calculate compensation for all OTPP employees (p.4). The OTPP’s 2022 Annual Report also says that annual outcomes, including those related to climate change, are part of a “balanced approach to rewarding employees in areas over which they have most control” (p.83). The OTPP should clarify how exactly OTPP staff and executives are incentivized to reduce emissions or achieve climate targets via compensation structure.

2023 UPDATES

OTPP’s CEO falsely referred to fossil gas as an “important transition fuel”.

OTPP has no exclusions on fossil fuel investments.

Despite the International Energy Agency (IEA) having said as early as 2021 that a global net-zero by 2050 pathway required no new investment in coal, oil or gas development, the OTPP has placed no exclusions on new investments in fossil fuels.

The OTPP has not provided disclosure of how it profitably plans to phase out its estimated $7.4 billion - $10.1 billion in fossil fuel assets, and remains insistent that it does not plan to divest them. At the pension fund’s AGM in April 2023, the OTPP’s CEO said, “we view natural gas as an important transition fuel” (2023 AGM Transcript, p.5). However, a growing body of evidence shows that the lifecycle emissions of gas make the fuel just as damaging to the climate as coal. The IEA said in its 2023 World Energy Outlook that global gas demand will decline this decade, possibly as soon as 2023, even without any new climate policies.

The OTPP’s Green Bond Framework already excludes investments that would increase the use of fossil fuels (p.5), although it includes carbon sequestration technologies or products (p.7), leaving the door open to financing of fossil fuel companies relying on this false climate solution.

In order to align its investment policies with climate science, which clearly states that climate safety means a phase-out of fossil fuels, the OTPP must institute an immediate exclusion on new investment in fossil fuels and disclose how it will profitably phase out its own fossil fuel assets.