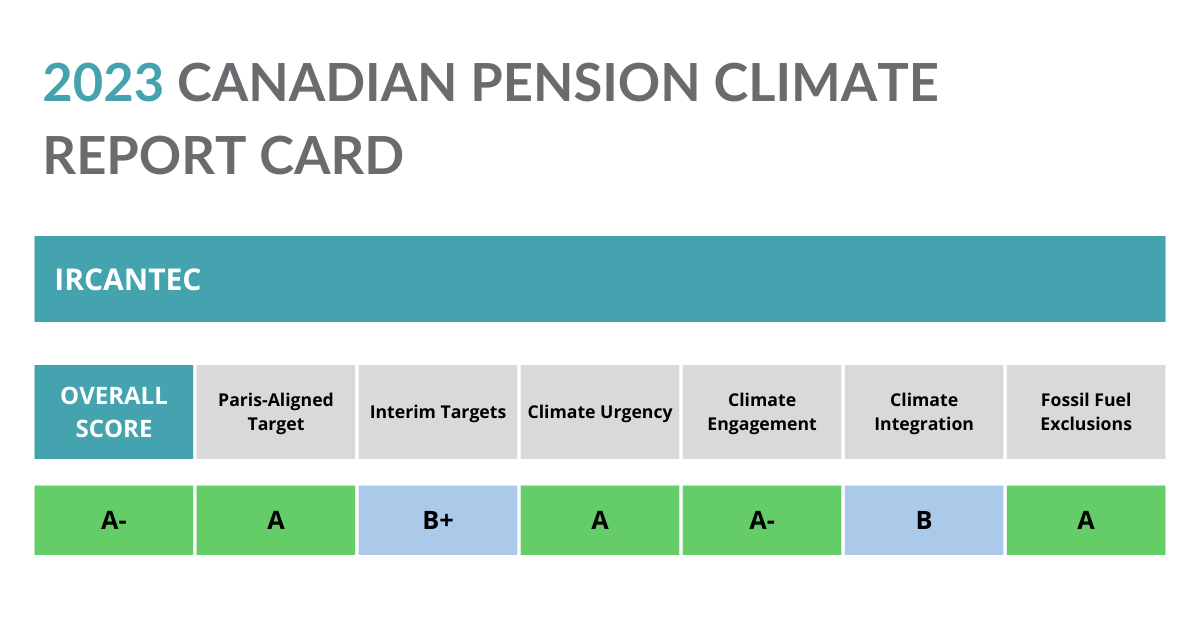

Ircantec

The 2023 Canadian Pension Climate Report Card assesses large Canadian pensions on their management of climate-related risks. For comparison, the report also includes analysis of three international funds: ABP (Netherlands), Ircantec (France), and New York City Public Pensions (United States). The report is based on publicly available information to December 31, 2023.

Based in Angers, France, Ircantec is a supplementary public pension for non-tenured employees of the French state and local authorities. The fund provides pension benefits to the managers, non-executive staff and part-time staff of France’s departments (which are like states or provinces) and municipalities.

Assets Under Management (AUM): €11.6 billion (December 31, 2022)

Ircantec clearly states the urgency of aligning its portfolio with a 1.5°C emissions reduction scenario and underscores the need to stop expanding fossil fuel supply to achieve this climate target. To do so, Ircantec aims to reduce its portfolio emissions intensity, including scope 3 emissions by 2026, by 7% per year on average until 2050, while committing 20% of its assets to finance the “energy and ecological transition.”

Ircantec sets strong climate-expectations for companies to develop and implement climate plans aligned with a 1.5°C emissions reduction scenario, including a transition plan for activities and employees at coal companies. These expectations are backed by strong proxy voting guidelines, which Ircantec appears to be following through on. Ircantec also provides detailed reporting on which of its asset classes are aligned with safe global heating scenarios and which aren’t.

Ircantec has developed a strategy for phasing out fossil fuels from its portfolio by 2030, starting with thermal coal in 2022 and by 2024 excluding oil and gas companies developing upstream and midstream expansion projects. Ircantec has a possible exception for fossil fuel companies with credible transition plans aligned with a 1.5°C pathway, but does not provide an example of any companies that warrant this exception.

Ircantec has committed to align its portfolio with an emissions reduction pathway in line with a 1.5°C scenario (Sustainability Report 2022, p.11). This commitment is in keeping with recent forecasts made by the Intergovernmental Panel on Climate Change (IPCC), which stressed the urgent need to significantly and sustainably reduce greenhouse gas (GHG) emissions to limit global warming, and the International Energy Agency (IEA) which underlined the need to stop expanding fossil fuel supply in order to achieve the 1.5°C scenario (SRI Charter Annex, p.3). Ircantec’s net-zero commitment includes scope 3 emissions for the energy and mining sectors as of 2022, and will integrate scope 3 emissions in the transport, construction, materials and industrial sectors by 2024, and all sectors by 2026 (SRI Charter Annex, p.4). Ircantec’s net-zero commitment and climate policy does not mention potential use of or limitations on carbon offsets.

Emissions reduction

Ircantec has an objective to reduce its portfolio emissions intensity (including scope 1, 2 and 3 emissions) by 7% per year on average until 2050, (Sustainability Report 2022, p.6). The Sustainability Report 2022 states that Ircantec will progressively integrate scope 3 by targeting first the energy and mining sectors, then focus on integration of scope 3 for the transport, construction, materials and industrial sectors in 2024, and then integration of scope 3 for all sectors by 2026 (Sustainability Report 2022, p.4).

Ircantec has not set any targets to reduce absolute emissions.

Climate solutions

Ircantec has also committed to use 20% of assets to finance the energy and ecological transition by 2024, and reported in December 2022 that 16.5% of reserves were already dedicated to this goal (Sustainability Report 2022, p.6). Ircantec states that “in order to assist companies with their energy transition, and in accordance with the Paris-aligned Benchmark, the exposure of Ircantec’s portfolio to high climate impact sectors must at least match the corresponding level set out in its benchmark index.” Ircantec defines high impact sectors using Europe’s NACE classification of economic activities and includes: “Agriculture, Forestry and fishing, Mining and quarrying, Manufacturing, Electricity, gas, steam and air-conditioning supply, Water supply, Sewerage, Waste treatment and remediation, Construction, Wholesale and retail trade, Repair of motor vehicles and motorcycles, Transporting and storage, Real estate activities” (SRI Annex Charter, p.4).

Ircantec owns almost 4,168 hectares of forest land in France and has targets to: ensure 100% of sites are planted with at least two species by 2026, certify 100% of forest assets using the Program for the Endorsement of Forest Certification, inventory 100% of assets under the Index of Biodiversity Potential by 2026, and assess 100% of land areas protect soils and prevent erosion by 2026 (Sustainability Report 2022, p.38).

AUM covered by a science-based decarbonization target

Some investment managers have made commitments such as targets for successful climate engagement, the percentage of portfolio companies that will have credible decarbonization plans in place by 2025 or 2030, the percentage of AUM that will be covered by a science-based decarbonization plan by a target date, or the percentage of externally managed AUM that will be covered by net-zero commi

Ircantec wants to “integrate and reinforce the issues of tomorrow: strengthen our efforts by adopting an investment strategy that is compatible with a 1.5°C scenario given the climate emergency” (Sustainability Report 2022, p.11). The fund also acknowledges that “It is the role of investors to identify and measure [climate risks] to ensure the proper management of reserves.” Ircantec recognizes its role in fighting climate change as ''reducing [the] portfolio's exposure to fossil fuels and climate risk management, shareholder dialogue in favor of the climate, or financing transitional assets” (Sustainability Report 2022, p.15).

Sample language from SRI Charter Annex: Ircantec’s Climate Policy (p.3):

“Ircantec’s climate action falls within its intergenerational solidarity values, the aim being to preserve the environment for present and future generations while helping to support the energy and ecological transition (EET), and by accompanying job creation in the ’green economy’ sector. … In light of the climate emergency, Ircantec is stepping up its commitments to assign its reserves to the emission reduction pathway in line with a 1.5°C scenario, in keeping with recent forecasts made by the Intergovernmental Panel on Climate Change (IPCC) (August 2021 report), which stressed the urgent need to significantly and sustainably reduce greenhouse gas emissions to limit global warming; and the International Energy Agency (IEA) which underlined the need to cease developing the exploitation of fossil fuels in order to achieve the 1.5°C scenario.”

Expectations for owned companies

As a shareholder, Ircantec expects from its owned companies:

A strategy aligned with achieving the Paris goal of limiting global heating to 1.5°C or aligned with an annual decarbonisation trajectory of an average 7% reduction in GHG emissions intensity;

The implementation of quantitative CO2 emission reduction targets for all scopes for companies in high climate impact sectors;

Intermediate targets aligned with a 1.5°C global warming scenario;

For companies involved in the extraction, production and exploitation of coal, a commitment to implement a coal phase out plan by 2030, plus a transition plan for activities and employees (Voting Policy 2022, p.5).

Proxy voting

Since 2016, Ircantec has taken companies’ climate strategies into account when exercising voting rights. Ircantec’s support for the energy and ecological transition (EET) has an impact on how it votes on four categories of shareholder resolutions:

The approval of a company’s financial accounts at AGMs;

The distribution of dividends;

Executive compensation;

Executive re-election (vote against the re-election of the Chairman of the Board and/or the Chief Executive Officer) if the company’s energy and ecological transition strategy and implementation are not adequately aligned with Ircantec’s expectations (Voting Policy 2022, p.10).

Ircantec undertook specific monitoring of companies in its portfolio on climate. Initially it looked at the 30 largest companies by market value, then evolved its focus list to include its 20 largest holdings, the five largest emitters, and the five companies with the biggest potential for stranded assets. From 2022, the list included the main holdings in financial institutions involved in financing and underwriting controversial practices such as thermal coal or unconventional energies and which do not have a credible exit plan. Ircantec’s engagement of these companies are intended to replace the fossil fuel companies that were removed from its portfolio with the implementation of its climate policy (Voting Policy, p.5).

Ircantec appears to be following through on its specific monitoring of polluting companies and financial institutions by voting against key climate-related shareholder resolutions. For example, in 2022, Ircantec voted against a “Say on Climate” proposal at Barclays after the bank failed to commit to exclude financing of new oil and gas projects or set scope 3 emissions reduction targets in absolute terms, rather than emissions intensity. (Rapport d’activité 2022, p.48; Voting Policy 2022, p.11).

Similarly, for Engie, even though the utility company was willing to reduce GHG emissions and to achieve net-zero by 2045, Ircantec voted against the company’s strategy in a “Say on Climate” shareholder vote because the strategy was not in line with Ircantec’s climate policy of alignment with the Paris agreement and because of Ircantec’s concerns regarding Engie’s definition of “low-carbon” gasses and increased use of LNG from shale gas (Voting Policy 2022, p.11).

Collaborative engagement

Ircantec is a member of Climate Action 100+.

Policy engagement

Ircantec has signed the Global Investor Statement to Governments on Climate Change, asking governments to reiterate their commitment to pursue the objectives of the Paris Agreement and to support private investments towards the low-carbon transition, as well as an investor Principles of Responsible Investment (PRI) statement ahead of COP15 on Biodiversity in 2022 to establish a global framework to halt and reverse biodiversity loss (Sustainability Report 2022, p.60).

Direction given to external managers

Ircantec maintains ongoing, regular dialogue with external asset managers to ensure that Ircantec’s SRI constraints are respected at all times and to discuss the management and control of sustainability risks, including climate change (Sustainability Report 2022, p.15).

Accountable Paris-aligned membership

Ircantec is not a member of a Paris-aligned investor body such as the Net Zero Asset Owners Alliance or the Paris Aligned Asset Owners initiative.

Transparency and disclosure of holdings and climate risk

Ircantec committed to publish all portfolio securities held by dedicated funds on its website on an annual basis (Sustainability Report 2022, p.12). Ircantec also discloses a weight in the portfolio of the main contributors to turnover derived from fossil fuels (Sustainability Report 2022, p.22 table).

Ircantec has adopted the Trucost methodology recommended by the SBTi (Science-Based Targets Initiative) using a sectoral approach and economic approach (Greenhouse Gas Emissions per unit of value added) (Sustainability Report 2022, p.42). To measure climate transition risk, Ircantec has used carbon pricing, using Trucost to compile a data set of possible future carbon prices to test each issuer’s current ability to absorb future costs (Sustainability Report 2022, p.17).

Ircantec disclosed the carbon budget for its global listed portfolio, which is lower than what the budget would need to be to ensure alignment with a 2°C warming scenario (Sustainability Report 2022, p.42). Ircantec’s listed assets are aligned on an average temperature trajectory of 1.5°C to 2°C by 2030. Ircantec’s credit portfolio is also aligned with the objectives of the Paris Agreement (below 1.75°C). However, Ircantec’s equity portfolio includes investments in the consumer discretionary and energy sectors that are on a warming trajectory of 3-4°C and greater than 5°C, respectively (Sustainability Report 2022, p.43).

Ircantec has also carried out climate studies on its sovereign portfolio, showing that the portfolio is less exposed to coal and natural gas than its benchmark. However, the presence of natural gas remains very strong because of the fact “that most States use it in contribution to the energy transition” (Sustainability Report 2022, p.43).

Board climate expertise and/or fossil fuel entanglement

No Board members appear to have fossil fuel entanglements (Rapport d’activité 2022, p.4).

Ircantec has not identified any Board members as having climate expertise. New trustees received training about integration of SRI and Climate dimensions given by the management team of the Caisse des Dépôts et consignations, a public sector financial institution that acts as a long-term investor serving the public interest. The training also included support for understanding the impact of regulatory changes on financial and non-financial management of Ircantec (Sustainability Report 2022, p.12).

Executive and staff compensation and climate

Staff and executives at Ircantec do not receive any compensation aligned with sustainability risks. However, the Sustainability Report 2022 (p.12) stated that “discussions were initiated” on how sustainability risks could be better integrated into the compensation components of other stakeholders. Furthermore, French asset managers are covered by the European Union’s Sustainable Finance Disclosure Regulation, which requires companies and financial institutions to disclose information on how remuneration policies are consistent with the integration of sustainability risks. Ircantec is working to adopt a policy for staff compensation regarding sustainability objectives (Sustainability Report 2022, p.12).

Ircantec has developed a strategy for phasing out fossil fuels from its portfolio by 2030 (SRI Charter Annex, p.3).

Thermal coal

Ircantec has committed to divest from :

companies planning new coal mines/plants/infrastructure projects;

companies whose thermal coal activity represents more than 5% of turnover; and

any company producing more than 10 million tonnes of thermal coal per year or having a coal-fired power generation capacity exceeding 5 gigawatts (SRI Charter Annex, p.5).

Ircantec’s coal exclusion policy has an exception for companies that have adopted a credible coal exit plan by 2030, as well as for green bonds issued by companies covered by this exclusion policy if they committed to phase out thermal coal by 2030 worldwide. The goal of Ircantec is to achieve zero thermal coal exposure by 2030.

Oil and gas

By the end of 2024 Ircantec will exclude companies that develop oil and gas upstream and midstream projects (SRI Charter Annex, p.6).

Ircantec is also applying Paris-aligned exclusion thresholds for European stock market indices using the Paris Aligned Benchmark (PAB) (SRI Charter Annex, p.6). Through PAB, Ircantec has committed to exclude all companies for which oil represents more than 10% of gross revenue and for which fossil gas represents more than 50% of gross revenue.

Ircantec will also exclude :

all companies initiating new conventional projects (exploration, production, transport) or contributing (equipment, services) to the development of new oil and gas projects; and

any company whose production is linked to shale oil and gas, extra heavy oil, coal gas, oil sands, deposits in the Arctic or in deep waters, and which has not committed to a credible exit plan (Sustainability Report 2022, p.17).

Exclusions will not be applied to companies that have adopted a credible plan to reduce their emissions in line with 1.5°C. The goal of Ircantec is to achieve zero exposure by 2030 to any company in the oil and gas sector that has not adopted a credible emissions reduction plan that is compatible with a 1.5°C scenario.

Because of the growth of the unconventional energy sector, which tends to have particularly high carbon intensity, Ircantec tightened its divestment policy with new exclusion thresholds newly applied from the first half of 2022. This new policy excludes companies that develop new projects in unconventional energy resources or that increase their production capacity, companies whose production is related to shale oil and gas, extra-heavy oil, coal gas, oil sands, etc., and companies in which more than 30% of production is linked to an unconventional activity. Ircantec makes exceptions for companies that have a credible plan to exit unconventional energy by 2030, but does not provide an example of any company that has received an exception.

The possible exemption for companies with credible transition plans aligned with a 1.5°C pathway will need to be closely monitored, particularly in regards to future oil and gas expansion plans. Still, Ircantec’s exclusion policy is one of the most robust among international asset owners and should be an example to follow.